Challenge

- A large multi-line regional bank was looking for a way to evaluate its investments in day-to-day customer acquisition marketing alongside the more substantial investments made into various sponsorship programs spanning sports, arts and community events

- It wasn't clear what metrics could be used to compare these very different investments and nor was it clear what methodology could be used to evaluate them

- In addition, a complex and shifting macroeconomic environment needed to be understood and controlled for in any analysis as well as other sales and operations changes to branch and banker processes

- In seeking a partner to help they also needed someone that could support internalization of key elements of any data driven program due to risk and data security requirements

Solution

- To ensure the analysis happens behind the client’s firewalls, we co-developed a large data environment to enable data transformation, advanced modeling and automated reporting with secure remote access. We integrated the Marketscience Studio modeling and optimization platform alongside the co-developed large data environment.

- Leveraging our proprietary Dynamic Marketing Mix Modeling approach, we built a complete picture of the client’s marketing effectiveness based on all their key business drivers and all key marketing channels, in the short- and long-term.

- It was very clear that certain programs and drivers would influence the baselines of the different banking products from checking, savings and investments to mortgages, loans and credit cards.

- Changes to branch banking and the macroeconomy could have a huge influence on baselines but also the impact of customer perceptions and experience as reflected in word of mouth and social buzz might also be evident in underlying customer growth.

- Whilst BaseDynamics provided the perfect approach for analyzing such factors it was also necessary to create a wide ranging and scalable solution to data collection and on going management. Marketscience were able to provide the template and automation procedures to help source, transform and validate data for many disparate sources to support the detailed analysis requirements.

Results

- Marketing was shown to be a key driver of short term lifts in customer acquisition, with certain offline and digital awareness channels delivering a good ROI, however the investments in Sponsorships were not seen to have such a large impact

- Modeling the long-term baseline of customer acquisition and deepening identified the large impact from changing macro environment which had shifted the value creation for the bank from loan based products to investment based products over the course of the model period.

- Whilst changes to banking center processes that reduced total traffic but increased face time with customers had a positive effect, large impact was seen from increases in overall Word of Mouth (WOM) and Buzz for credit and investment products in particular.

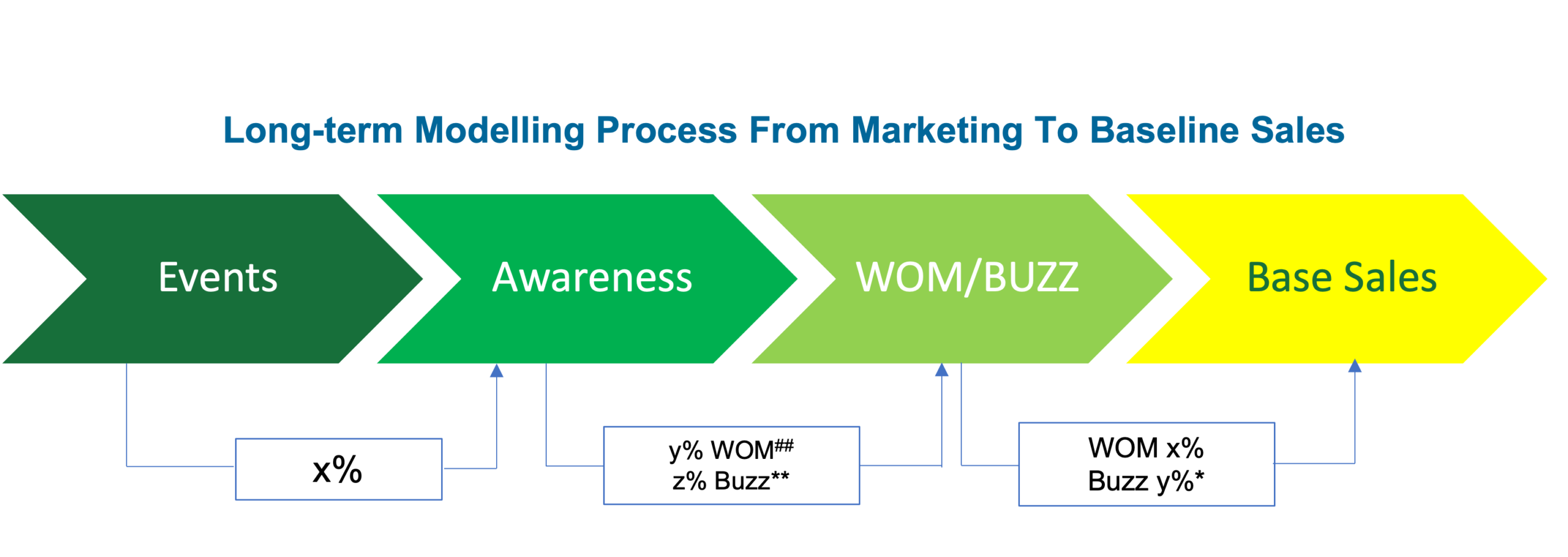

- The long-term VECM model also identified WOM and Buzz as being driven by Advertising Awareness which in turn was seen to be shifted but investments in Sponsorships. In this context Sponsorships were acting as a way to amplify Advertising Recall and provoke organic social activity

- The overall result led to a large rebalancing of investments to maximize the balance of short- and long-term goals, leading to a 15% ROI increase in the short-term and an extra 10% in the long-term.

What We Did

- BaseDynamics MMM

- SimOpt Simulation and Optimization

- Data management and internalization